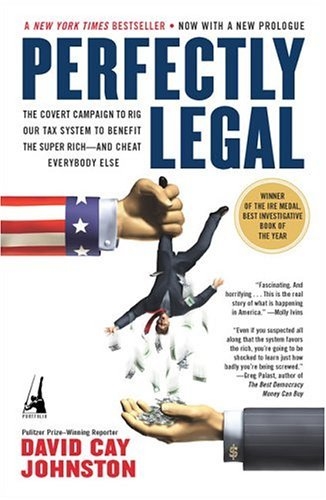

Most Americans would agree that they are duty bound as beneficiaries of our democracy to pay taxes, and the majority of us do pay-exorbitantly. But what about those who do not pay their fair share? David Cay Johnston, a Pulitzer Prize-winning reporter for the New York Times, here reveals how fairness and equity have eroded from the American tax system. Johnston describes in shocking detail the loopholes our government provides the "super rich"--from private individuals to profitable corporations-to hide their wealth, to defer or evade tax payments, and to pass the bill to law-abiding middle-class Americans. The loss in revenue "imposes a severe cost on honest taxpayers" through reduced services, increased federal debt, and a weight on the middle class that threatens to impede its ability to achieve upward social mobility. Admitting the extreme complexity of our economy and by extension our tax code, Johnston points out that the very wealthy do, of course, pay taxes. However, because of shelters that allow them to understate most of their income, they pay little more on average than most Americans on the dollar. This is regressive, and unquestionably favors the superrich. Johnston includes examples of outrageous corporate malfeasance (such as companies that establish off-shore tax addresses) and exposes the tax benefits of the particularly loathsome practice made famous by Jack Welch, in which thousands of wage earners are laid off while a handful of executives are granted hundreds of millions of dollars through deferred compensation, company stock options, and lucrative retirement packages, all at stock holders' xpense. In addition to these offenses, he describes the tax evasion methods of those who simply defy the law and are emboldened by a beleaguered IRS that is too underfunded to serve as an effective deterrent to tax cheats. Johnston calls for a complete overhaul of the system. But because those who most benefit from these laws comprise the "donor class" that supports the government power structure, our prospects for reform remain very bleak. --Silvana Tropea

Authors

David Johnston

Additional Info

- Release Date: 2005-01-04

- Publisher: Portfolio Trade

- Format: Paperback

- ISBN: 9781591840695

No copies of this item are currently available.